CRREM Methodology: Pathway to Decarbonization in Real Estate

The Carbon Risk Real Estate Monitor (CRREM) methodology stands at the forefront of integrating climate risk management into the real estate sector. As global initiatives towards sustainability intensify, understanding and implementing CRREM’s principles is becoming essential for real estate stakeholders aiming to align with decarbonization targets. This article delves into the CRREM methodology, its significance, and how it shapes the future of sustainable real estate.

Introduction to CRREM

CRREM provides a clear framework for real estate investors and property owners to assess and manage their carbon risks. It translates the global carbon reduction targets, as outlined in the Paris Agreement, into specific, actionable pathways for the real estate sector. The methodology identifies the carbon reduction requirements for different property types across various regions, establishing a roadmap for achieving these reductions in line with international climate goals.

Significance of CRREM in Real Estate

The real estate sector is a significant contributor to global carbon emissions, making it a critical focus for decarbonization efforts. CRREM not only highlights the urgency of addressing carbon emissions in this sector but also offers a scientifically backed approach to measure, manage, and reduce these emissions. By adopting the CRREM methodology, property stakeholders can:

- Align with Global Climate Goals: CRREM provides a direct link between real estate operations and global climate objectives, helping stakeholders align their strategies with the 1.5°C temperature rise limit set by the Paris Agreement.

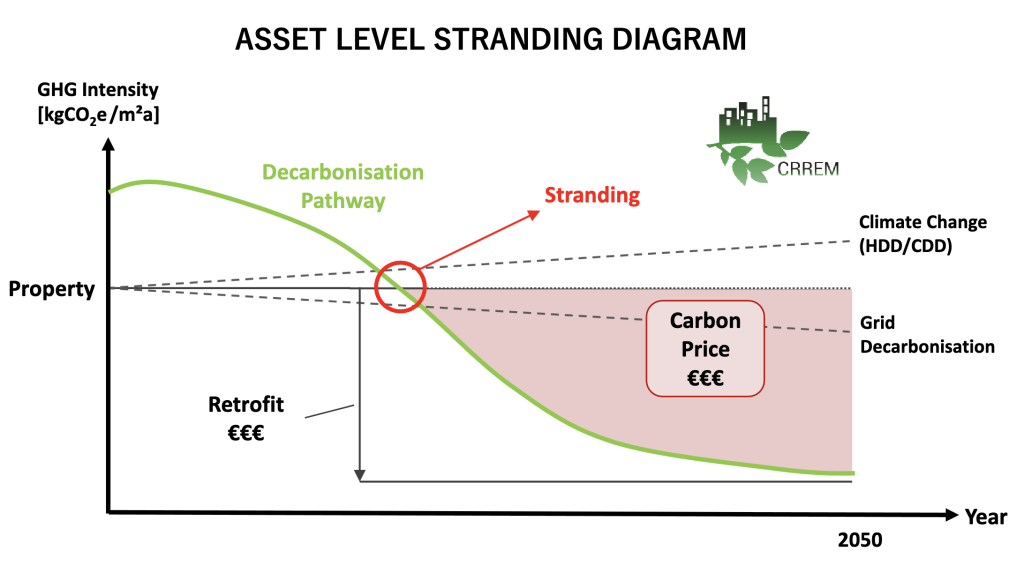

- Mitigate Financial Risks: As regulatory pressures increase and investors become more climate-conscious, properties that exceed carbon thresholds risk devaluation or becoming stranded assets. CRREM helps identify these risks early, allowing for strategic planning and mitigation.

- Enhance Market Competitiveness: Properties that adhere to CRREM standards are likely to be more attractive to investors, tenants, and partners who prioritize sustainability, thus enhancing their market value and competitiveness.

The CRREM Pathway

- Assessment of Current Emissions: Evaluating the current carbon footprint of properties to establish a baseline.

- Comparison Against Thresholds: Using CRREM’s tools, stakeholders can compare their asset’s emissions against the stranding risk thresholds to identify potential risks.

- Strategic Planning: Developing long-term strategies for energy efficiency improvements, renewable energy adoption, and operational changes to reduce emissions.

- Monitoring and Reporting: Regularly tracking progress against CRREM targets and reporting to stakeholders to demonstrate commitment and compliance with decarbonization goals.

Implementing CRREM with BAARCH’s Approach

BAARCH is adept at incorporating CRREM calculations into its energy audit processes, enhancing the traditional scope of energy efficiency assessments. This integration ensures that engineering evaluations not only focus on immediate ROI and energy savings but also take into account the carbon payback period. By doing so, BAARCH contributes to a holistic approach in retrofit projects, ensuring they align with broader sustainability and decarbonization targets. This evolution in service delivery marks a significant step towards meeting the net-zero objectives, showcasing BAARCH’s commitment to innovative and environmentally responsible engineering solutions.

In Summary

The CRREM methodology offers a vital tool for the real estate sector to navigate the complexities of decarbonization, providing a structured approach to reducing carbon emissions and mitigating climate-related financial risks. As the industry moves towards a more sustainable future, embracing the CRREM framework will be pivotal in driving forward the agenda of decarbonization and achieving long-term sustainability goals in the real estate sector.